How Your Credit Score Affects Your Mortgage Rate

Picture this: you’ve found the perfect home, wrap-around porch, cozy kitchen, and an extra room you’re already calling the “office-slash-gym.” You’re ready to explore home loans and mortgage rates. Then comes the question that stops many buyers: “Let’s check your credit score.”

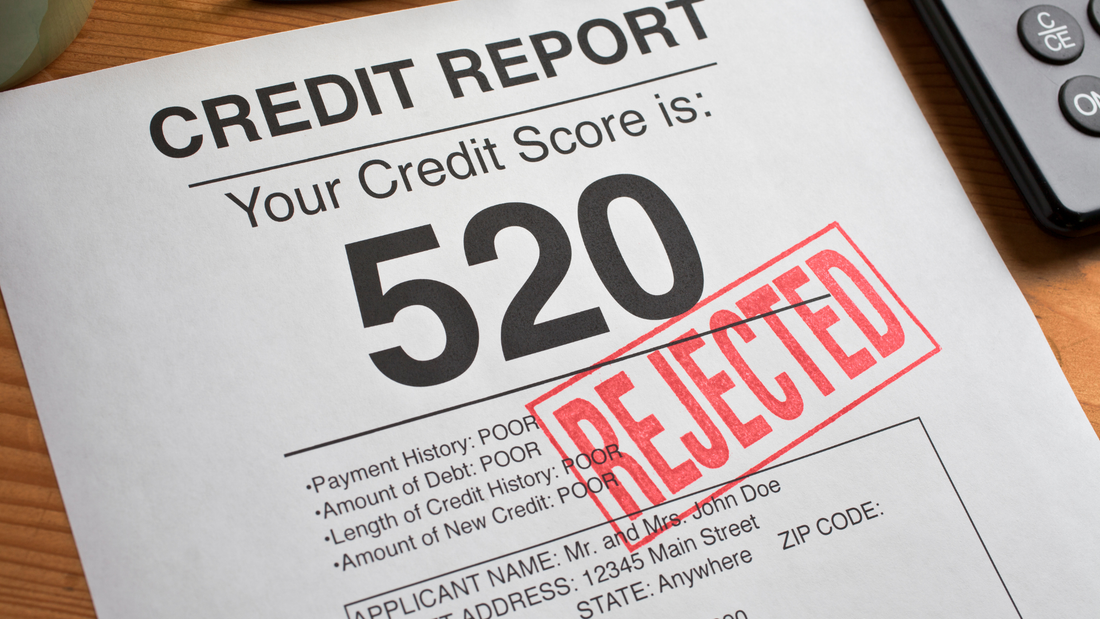

That three-digit number can make your dream home feel either within reach or just out of grasp. The good news, understanding how your credit score impacts your mortgage rate isn’t rocket science. It’s about knowing how lenders see you.

Why Credit Scores Matter When Buying a Home

When a lender reviews your mortgage application, they’re really asking, “How risky is this borrower?” Your credit score answers that question.

- Higher scores = lower risk → better interest rates

- Lower scores = higher risk → higher interest costs

- A score above 740 typically unlocks the most competitive rates

As of late 2025, the average 30-year fixed mortgage rate sits between 6.7% and 7%. With rates at these levels, even a small score difference can mean paying thousands more over time.

Real-World Math: Why Credit Matters

- Mia has a credit score of 780 → 6.4% interest

- Jordan has a credit score of 660 → 7.1% interest

The Path to Better Credit (and Better Rates)

Action steps:

- Pay bills on time, every time.

- Keep balances low relative to your credit limits.

- Avoid opening many new accounts just prior to applying for a home loan.

- Review your credit report for errors, disputing inaccuracies can give your score a meaningful boost.

- Aim for a score of 740+ if your goal is the best possible interest rate, but any improvement helps.

Market Trends: Credit Scores & Mortgage Rates

- The national average credit score dropped from 717 to 715 recently, the fastest decline since the Great Recession.

- A major shake-up in the credit-score business: Equifax slashed its price on VantageScore 4.0 and decided to offer free scores to some customers, as FICO opens competition.

- Mortgage rates are staying stubbornly high: the average U.S. 30-year mortgage rate was 6.74% recently, still presenting affordability headwinds.

Where a Home-Insurance Quote Fits In

Why It’s Worth Working With Experts

If you’d like help with making sense of insurance options or getting a home-insurance quote customized to you, our team at Farmers Insurance Young Douglas is here for you.

Expert Insight: Michael Beal, Mortgage Broker in San Diego

Michael Beal of Liberty National Lending Group helps homebuyers across California understand how credit impacts their loan options. Based in San Diego, Michael focuses on helping clients prepare early, compare rates, and secure terms that fit their long-term goals. His team’s personalized approach highlights the importance of working with experts who prioritize education and transparency.

Disclosure: This article features independent professionals and businesses for informational purposes. Farmers Insurance Young Douglas collaborates with some of the professionals mentioned; however, no payment or compensation is provided for inclusion in this content.